Impact Services

TGE offers an end-to-end suite of impact advisory services and tools designed to help clients meet the growing demand and regulatory requirements for greater confidence and credibility in investment strategies that create positive impact and / or pursue sustainability outcomes.

We work across all asset classes and sectors, with a particular specialisation in private markets, and have clients in the UK, Europe and Emerging Markets.

Sectors and Specialisations

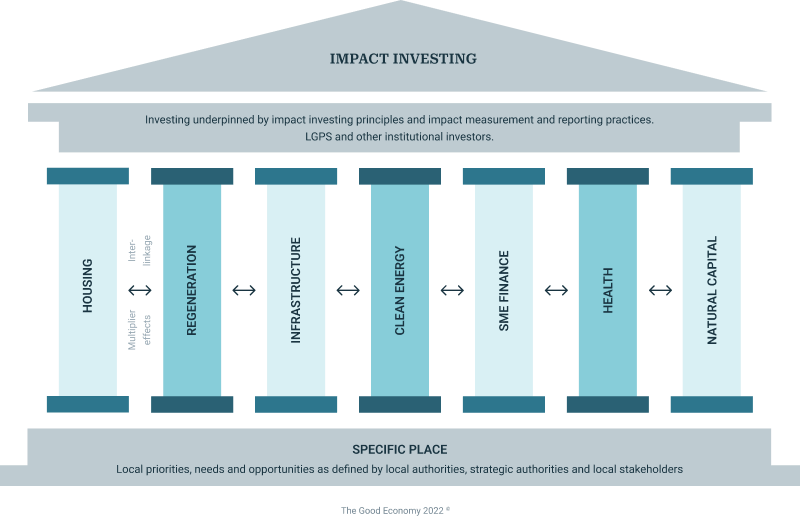

The Good Economy is widely regarded as a thought leader in place-based impact investing (PBII). We believe that to deliver a ‘Good Economy’, one that works for everyone, focused investment in key sectors is crucial – as demonstrated in our conceptual model.

Our expertise lies in understanding the complex interplay between these sectors and their impact on local economies.

We provide expert advisory services to guide clients on how to strategically invest in these sectors to generate positive outcomes alongside financial returns.

Explore our specialisations: Affordable Housing, Commercial Real Estate, Private Equity and Debt and Emerging Markets.

Our Approach

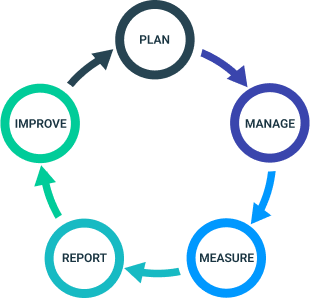

Our rigorous approach helps you plan your impact, prove your impact – and then improve it.

Strategic Certainty

Impact happens when it’s been strategically planned and executed. Our Impact Services help you to create robust, credible, and relevant impact strategies, with evaluation built in from the start.

Innovative Approach

Our work is about pioneering new methods, not dead data. Our Impact Services inform your strategies with the latest thinking, ready for the future.

Rigorous Reporting

With the right models, reporting criteria, and evaluations in place, our Impact Services help you to maximise your impact.

Explore our clients and the work we do for them

Abundance Investment

Abundance Investment is a leading direct investment platform giving people control over their money. Since its launch in July 2012, it has raised more than £90m from individual investors to fund companies and projects across the green economy and housing sectors. Helping local councils raise investment for local projects is a key focus area for Abundance given the low risk returns it offers the company’s investors.

Abundance is a Founding Member of TGE’s Place-Based Impact Investing Network

AgDevCo

AgDevCo is a specialist investor in African agribusiness with the mission to support the development of a thriving commercial African agriculture sector.

TGE conducted an assurance exercise for AgDevCo to verify its reported impact figures and to recommend ways to strengthen overall impact measurement and management practices. We also conducted research for a paper summarising lessons learned from AgDevCo’s seed investments into early-stage agribusinesses.

AEW

AEW is one of the largest real estate investment managers in the world with over $90 billion assets under management.

The Good Economy was engaged by AEW UK in 2022 to set up an Impact Measurement and Management (IMM) Framework for what was then called the RRF. The RRF had launched in 2016, with a strategy to invest in a range of real estate sectors aiming to align the real benefits of property with the needs of long-term savers.

With a view to capitalising on the positive place-based impact potential of real estate investment, AEW UK commissioned TGE to design a formal approach to convert this existing strategy into one that could credibly claim to be an ‘impact’ fund.

View Case Study

AfricInvest

AfricInvest which was founded in the early 1990s is one of the most experienced private equity investors on the African continent. With more than 100 professionals in eleven offices, AfricInvest has raised USD2 billion across 21 funds and benefits from strong, long-term support from both local and international investors, including leading development finance institutions in the United States and Europe.

In line with the requirements of the Operating Principles for Impact Management, to which AfricInvest is a signatory, The Good Economy undertook an independent assessment of their impact management processes and practices using our verification methodology, Impact Assured.

Impact Assured verifies alignment with the Impact Principles and wider industry good practice, as well as provides practical recommendations on opportunities to strengthen impact systems. A detailed report on the verification findings was presented to AfricInvest

Aspen Network of Development Entrepreneurs

The Aspen Network of Development Entrepreneurs (ANDE) is a global network of organisations that propel entrepreneurship in developing economies. ANDE members provide critical financial, educational, and business support services to small and growing businesses (SGBs) based on the conviction that SGBs create jobs, stimulate long-term economic growth, and produce environmental and social benefits.

The Good Economy helped ANDE by facilitating the Decent Work Measurement Learning Lab and capturing the key insights in this guide.

View Report

Association of Real Estate Funds

The Association of Real Estate Funds (AREF) is the body that represents the interests of its fund managers, those firms that advise and support them and the end customers that invest in our member funds. Membership includes over fifty funds spanning the leading real estate fund management houses in the industry, through to smaller, specialist boutiques, with a collective net asset value of over £50bn.TGE regularly delivers training sessions to members on impact investing.

Barnsley Metropolitan Borough Council

The Metropolitan Borough of Barnsley is the fourth largest settlement in South Yorkshire with a population of 244,600.

Barnsley Metropolitan Borough Council is a Founding Member of TGE’s Place-Based Impact Investing Network

Bath and North East Somerset Council

Bath and North East Somerset (B&NES) is a unitary authority district in Somerset, South West England. It covers an area of 136 square miles, of which two thirds is green belt. The area has a population of around 193,400, half of which live in the City of Bath.

B&NES is a Founding Member of TGE’s Place-Based Impact Investing Network and held one of the four PBII Innovation Labs.

View Report

Bristol & Bath Regional Capital

Bristol and Bath Regional Capital (BBRC) is a leading, place-based impact investor and asset manager. They invest in real estate, infrastructure and businesses to deliver attractive returns for investors and strong social, economic and environmental outcomes for local communities.

BBRC is a Founding Member of TGE’s Place-Based Impact Investing Network.

Bristol City Council

Bristol City Council is the local authority of Bristol, England. The council is a unitary authority and is unusual in the United Kingdom in that its executive function is controlled by its directly elected mayor. It is part of the West of England Combined Authority and the 11th most populous urban area in the United Kingdom.

Bristol City Council is a Founding Member of TGE’s Place-Based Impact Investing Network

Bristish International Investment

British Investment International (BII) is UK’s development finance institution, managed by the Foreign, Commonwealth and Development Office (FCDO) focused on investing in the emerging markets of Africa and South Asia.

TGE worked with the BII to produce a report that outlines a practical framework to help investors and companies consider how best to use digital technologies to enhance workforce communication and worker voice.

View Report

Capital & Centric

Capital & Centric are Manchester-based social impact property developers, investors and operators.

The Good Economy worked with them to define their impact management and measurement framework.

Capital & Regional

Capital & Regional is a UK property REIT which owns retail and leisure properties throughout the UK and specialises in community shopping centres.

TGE worked with Capital & Regional to develop an impact management and measurement framework that they could use to embed impact into their decision making process.

Clarion Housing Group

Clarion Housing Group is the largest housing association in the UK, owning and managing over 125,000 homes. TGE were commissioned to design and deliver a bespoke ESG training course to educate and inform senior directors about ESG and the implications for Clarion as a business.

Clwyd Pension Fund

The Clwyd Pension Fund (CPF) is a Local Government Pension Scheme (LGPS) responsible for the counties of Flintshire, Denbighshire and Wrexham. Flintshire County Council is the lead Administrative Authority of the Clwyd Pension Fund.

TGE worked with CPF to identify and report on the place based impact of their investment using the PBII Reporting Framework.

Columbia Threadneedle

Columbia Threadneedle Investments (CTI) is a leading global asset manager, entrusted with £491 billion on behalf of individual, institutional and corporate clients around the world. CTI is also a pioneer in bringing social bond investing to retail investors and The Good Economy sits on the Social Advisory Panel for their UK and Global Social Bond Fund.

Columbia Threadneedle is also a founding member of our PBII Network.

View Case Study

Community Land Trust Network

The Community Land Trust Network is a non-profit that is mainstreaming the community ownership of land for affordable housing and other assets in public policy and market practice.

They commissioned TGE to help them with their 2023 State of the Sector report which was launched by the Secretary of State Michael Gove MP in Parliament.

View Report

Creative UK

Creative UK is a not-for-profit organisation dedicated to supporting the growth of the creative industries. The Good Economy provided a range of impact assessment and strategy consultancy services for its investment programme, delivering an independent Impact Report and conducting client surveys to provide feedback on the investment process from the investee’s perspective.

TGE also advised on Creative UK’s scale-up strategy, which resulted in the creation of an investment subsidiary company and the raising of a £10 million from Triodos Bank to increase Creative UK’s investment activity.

View Case StudyView Report

Dunoon Project

Thanks to an innovative multi-partner model, plans for the Dunoon Project site include a range of outdoor activities suitable for all ages and abilities. The Project will also play a crucial role in promoting the town, its history, the waterfront and the stunning, natural landscapes of the surrounding area. The driving force behind the project is The Dunoon Project Ltd, a locally-owned, community-based charity.

View Report

EQT

Based in Sweden, EQT is one of the world’s leading private equity firms. It is a purpose-led organisation with almost three decades of experience of investing in growth companies, delivering consistent and attractive returns across multiple geographies, sectors and strategies. Today, EQT has EUR 126 billion assets under management.

EQT wanted to understand what and how much positive social and environmental impact is occurring within its portfolio. The Good Economy was commissioned to conduct a review of a portion of EQT Private Capital’s portfolio. The review identified, in a consistent and comparable way, which companies may be generating positive outcomes for people and / or the planet and why.

View Case Study

European Investment Bank

The European Investment Bank (EIB) is the lending arm of the European Union. They are the biggest multilateral financial institution in the world and one of the largest providers of climate finance.

TGE contributed to the EIB’s report on lessons learnt through a three-year partnership between the EIB and the Global Development Network (GDN). The EIB-GDN Programme applied rigorous evaluation techniques to ongoing private investments in developing countries, while building local research capacity. We helped them to understand the role of impact investing in the development financing context, and the crucial role of impact measurement within this field.

View Report

Habitat for Humanity Great Britain

Habitat for Humanity Great Britain is part of the global Habitat for Humanity Federation, an international charity fighting global poverty and homelessness.

The Good Economy is helping HfHGB to develop an ESG framework.

Heath Innovation South West

Health Innovation South West is one of 15 Academic Health Science Networks set up by the NHS in 2013 to identify and spread health innovation at pace and scale.

The Good Economy was commissioned to explore opportunities to strengthen the connection between supply and demand for funding and finance for VCSE models of care.

View Report

House of St Barnabas

The House of St Barnabas’ Employment Academy aims to help those affected by homelessness find lasting, paid work by providing training, qualifications, work experience, mentoring and support.

TGE conducted outcome surveys for the Employment Academy using Insightable, our lean approach to outcomes measurement.

FSD Africa

FSD Africa is a specialist non-profit development agency funded by UK aid. TGE developed a Jobs Measurement Framework to enable FSD Africa to understand the impact of its work on building and strengthening financial markets across sub-Saharan Africa. We conducted extensive research to develop and deploy a practical model that allows FSD Africa to accurately determine its contribution to job creation and job quality, including the incorporation of ‘green jobs’.

View Report

Foresight

Foresight is a sustainability led alternative assets and SME investment manager. Their investment strategies are aligned with key themes shaping society and the planet, contributing to a resilient decarbonised world and creating the high-quality, sustainable jobs that will power tomorrow’s economy.

Foresight is a Founding Member of TGE’s Place-Based Impact Investing Network

Funding Affordable Homes

Funding Affordable Homes (FAH) is a social impact investment company investing in UK government regulated affordable housing. They have close partnerships with housing associations and local authorities. Working with local partners they use their capital to promote the delivery of additional homes and aim to provide a balanced return to our shareholders comprising an attractive mix of income yield and capital appreciation.

The Good Economy has acted as the social impact advisor to FAH since its launch in 2015. We carry out a social due diligence of all investments and produce an Annual Impact Report based on our independent assessment of FAH’s impact performance.

View Case Study

Get Living

Get Living is a specialist Build to Rent property developer that creates neighbourhoods and communities where people are connected and can thrive.

TGE worked with them to develop an approach to measuring and managing their impact.

Greater Manchester Pension Fund (GMPF)

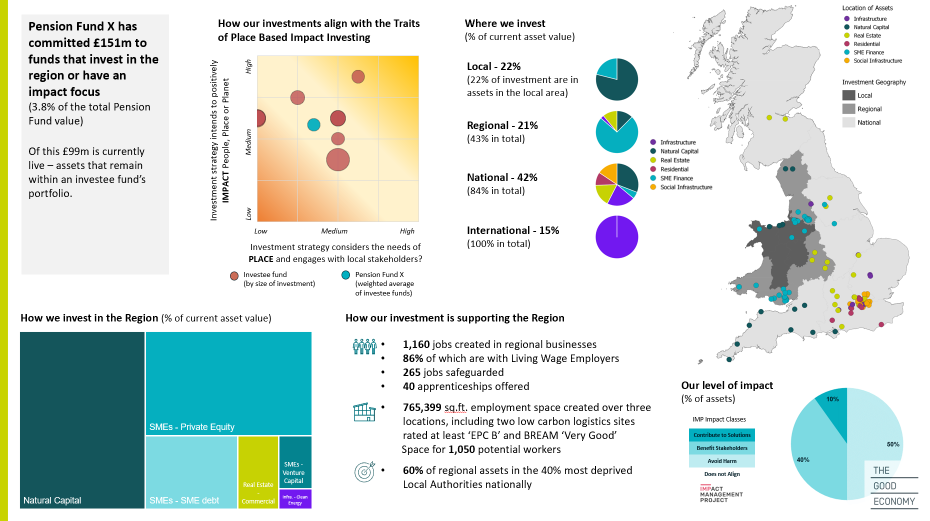

Greater Manchester Pension Fund (GMPF) is the largest local government pension scheme (LGPS) fund and the eleventh biggest defined benefit pension fund in the UK. GMPF manages over 375,000 pensions and pay over £750 million of benefits each year. TGE helped GMPF in developing its place-based impact reporting using a robust and industry-driven methodology, as well as delivering the outputs to members in an easy-to-understand visual reporting format. The report enables GMPF to demonstrate the nature of its private market investments and their contributions to inclusive and sustainable development including the Government’s Levelling Up agenda in the UK, with a particular focus on benefits to Greater Manchester and the Northwest of England.

View Report

Igloo Regeneration

AfricaInvest Verification Statement

igloo Regeneration is the UK’s leading responsible real estate business working with investors, communities, local authorities and landowners who want to make the world better one place at a time. As a regenerative developer of sustainable mixed-use neighbourhoods for communities, they have been creating people- and planet-positive places since 2002.

igloo Regeneration is a Founding Member of TGE’s Place-Based Impact Investing Network

Impact Investing Institute

The Association of Real Estate Funds (AREF) is the body that represents the interests of its fund managers, those firms that advise and support them and the end customers that invest in our member funds. Membership includes over fifty funds spanning the leading real estate fund management houses in the industry, through to smaller, specialist boutiques, with a collective net asset value of over £50bn.

TGE regularly delivers training sessions to members on impact investing.

View Report

Joseph Rowntree Foundation

The Joseph Rowntree Foundation (JRF) is an independent social change organisation working to solve UK poverty through research, policy, collaboration and practical solutions.

JRF commissioned Small Change (NI) Ltd and The Good Economy to carry out a study to create a robust foundation for a new social investment strategy that would contribute to the four outcome areas of its anti-poverty strategy.

View Case Study

LDC

LDC is a mid-market private equity house and a subsidiary of Lloyds Banking Group.

The Good Economy conducted social value assessments of LDC’s investments analysing the extent to which they supported balanced and inclusive growth in the UK.

Authored by TGE co-Founder Mark Hepworth, the LDC report was first published in March 2016 and is now being promoted to the private equity sector, the wider financial community, and national and regional stakeholders promoting the UK’s balanced economy agenda.

TGE’s methodology has been endorsed by the British Venture Capital Association as the first “intellectually rigorous” methodology for assessing the social contribution of private equity and venture capital investment in SMEs.

View Case Study

Legal & General Affordable Homes

Legal & General Group is the UK’s biggest provider of corporate pension schemes and individual life insurance products, with over £1.3 trillion in AUM. Within the Group, L&G Affordable Homes (LGAH) is a for-profit registered provider of social and affordable housing.

The Good Economy worked with LGAH to develop an Impact Measurement and Management Methodology, and an annually undertakes an assessment of the impact delivered by LGAH’s portfolio.

View Case Study

Liverpool City Region Combined Authority

The Liverpool City Region Combined Authority (LCRCA) is the combined authority of the City of Liverpool local authority area plus the Metropolitan Boroughs of Knowsley, St Helens, Sefton, Wirral and the Borough of Halton. The city region covers a population of 1.5 million making it the 4th largest combined authority area in England.

The LCRCA is a Founding Member of TGE’s Place-Based Impact Investing Network.

Manchester City Council

Manchester City Council is the local authority for Manchester, the sixth largest city in England by population.

Manchester City Council is a Founding Member of TGE’s Place-Based Impact Investing Network and held one of the four PBII Innovation Labs.

View Report

M&G Real Estate

M&G Real Estate is recognised as one of the world’s leading property investors with investments across all sectors and a portfolio that spans 29 countries.

TGE worked with M&G Real Estate on developing their impact measurement and management framework.

Matter

Matter Real Estate is a specialist private equity real estate investor with over £250 million in AUM. Matter Real Estate has acquired a majority stake in a range of real estate businesses operating in housing and healthcare.

In 2021, TGE supported Matter Real Estate to develop an ESG Approach, which outlines a framework for impact measurement and management. In 2022, TGE continued its work with Matter, producing their annual impact report based on our independent assessment.

View Case Study

Newcore

Founded in 2011, Newcore Capital Management (Newcore) is a management-owned business, with assets under management of £500 million. As a specialist in social infrastructure investor in the UK, Newcore targets assets considered integral to the functioning of society. These assets enable the provision of essential services such as education, housing and transport.

Despite having confidence that its social infrastructure investments have a positive impact, Newcore wanted to better understand, measure and report on impact creation. In late 2022, The Good Economy (TGE) was commissioned to carry out a critical review of Newcore’s ESG approach, and to conduct an independent impact assessment of Newcore’s funds.

View Case Study

North East Combined Authority

The North of Tyne Combined Authority is a partnership of three local authorities: Newcastle, North Tyneside, and Northumberland and a directly-elected Metro Mayor.

Formed on 7 May 2024, it covers the seven local authority areas of County Durham, Gateshead, Newcastle, North Tyneside, Northumberland, South Tyneside and Sunderland.

Octavia Housing

Octavia Housing is a Registered Provider of Social Housing, delivering affordable homes to thousands of people in central and west London. As early adopters of the Sustainability Reporting Standard (SRS) for Social Housing, Octavia commissioned TGE to conduct a ‘critical friend’ review of its first SRS submission, including a criteria-level review of the draft submission and the underpinning methodology.

Octopus Investments

Octopus Investments is part of Octopus Group and manage more than £13 billion on behalf of over 63,000 investors and have over 750 employees. From the very beginning, they invested in the people, ideas and industries that can change the world across three themes: building a sustainable planet, empowering people and revitalising healthcare.

Octopus Investments is a Founding Member of TGE’s Place-Based Impact Investing Network

Oxfam

Oxfam GB was the Impact Advisor to The Enabling Microfinance Fund (EMF), which sought to address the exclusion from formal financial markets faced by entrepreneurs in low-income countries.

TGE was commissioned by Oxfam GB to carry out an independent assessment of the impact performance of EMF and produce an Impact Report for EMF’s current and potential investors.

We analysed portfolio data and conducted investee interviews to better understand where the EMF was delivering positive social impact, to capture learnings and to formulate recommendations for EMF’s future investment strategy.

View Case Study

Palentine Private Equity

Palatine is a partner led private equity firm that sees investment as a force for good. Headquartered in Manchester with offices in London and Birmingham, they operate at both a regional and a national level, investing across multiple sectors across the UK.

Palatine’s impact management processes and practices were assessed using The Good Economy’s verification methodology, Impact Assured.

Impact Assured verifies alignment with the Impact Principles and wider industry good practice and provides practical recommendations on opportunities to strengthen impact systems.

Patrizia

With €58 billion Assets Under Management, Patrizia is one of the leading global real asset investment managers. The Company offers a comprehensive product portfolio of private and listed equity funds, private debt funds and (multi-manager) fund of fund products to more than 500 institutional and 10,000 semi-professional or private investors.

The Good Economy’s Impact Services team worked with Patrizia to develop an Impact Management and Measurement framework for one of their developments.

Rehoboth Property Group

Rehoboth Property Group is a multi-award-winning, London-based real estate firm.

TGE worked with them to develop an impact thesis to guide their thinking on how to measure and manage their impact.

Rentplus

Rentplus offers an affordable route to home ownership for lower-income households. Through the Rentplus model, homes are let at an affordable rent and residents receive a 10% gifted deposit at the point at which they purchase their home. TGE worked with Rentplus to define its Impact Measurement and Management Methodology and undertook a review of the company’s existing ESG policies.

View Report

RM Funds

RM Funds is a specialist asset manager focusing on alternative investments. TGE was commissioned by RM Funds to provide third-party assurance of its Impact Management and Measurement framework.

View Report

Rochdale Development Agency

Rochdale Development Agency (RDA) was established in 1993 and is dedicated to promoting Rochdale as a central investment location while continuing to support and assist existing investors.

RDA is a member of TGE’s Place-Based Impact Investing Network

Schroders Capital

Schroders is one of the UK’s largest investment managers, working closely with pension schemes and insurance companies across public and private market investment strategies.

Schroders is one of the Founding Members of TGE’s PBII Network.

Scottish Government

The Scottish Government commissioned TGE to research the needs of business in driving inclusive job growth in the South of Scotland. The research report, used to inform the area’s subsequent economic strategy, included a baseline analysis of job growth performance, interviews with businesses, identifying innovative finance and impact investment approaches, and provided policy and practical guidance. TGE subsequently conducted similar research spotlighting the specific needs of the agricultural sector.

View Report

Scottish National Investment Bank

The Scottish National Investment Bank (SNIB) is a state owned development investment bank that invests where the private sector is not providing sufficient investment to businesses or projects that support the development of a country’s economy.

TGE conducted a landscape review of impact investing in Scotland and co-authored SNIB’s landmark paper on the potential of the sector for Scotland.

View Report

Snowball

A certified B Corporation, Snowball is purpose-built to help serious investors use their money to shape a better world, profitably. The fund is invested across two interconnected themes (social equity and environmental sustainability) into opportunities that use capital to add value rather than extract it.

View Case Study

South Essex Councils

South Essex Councils (SEC) is a partnership of neighbouring councils that have come together to promote growth and prosperity in the region. The SEC comprises the councils of Basildon, Brentwood, Castle Point, Rochford, Southend-on-Sea, Thurrock and Essex County.

SEC is a Founding Member of TGE’s Place-Based Impact Investing Network and held one of the four PBII Innovation Labs.

View Report

Thriving Investments

Formerly known as PfP Capital, Thriving Investments is a fund and asset manager with a distinct purpose – to turn capital wins into community gains. Powered by Places for People, they strive to add social and monetary value to their investments, developments, and communities.

Thriving Investments is a Founding Member of TGE’s Place-Based Impact Investing Network.

Triple Point

Triple Point is an investment manager with over £2 billion in AUM. TGE conducted a company-wide impact audit for Triple Point in 2019 as well as delivering training on ESG. We developed the Impact Measurement and Management system for Triple Point’s Social Housing Real Estate Investment Trust (REIT) and continue to act as an impact advisor to the REIT, publishing an Impact Report twice a year.

Triple Point is also a Founding Member of TGE’s PBII Network

View Report

South West Academic Health Science Network

The South West Academic Health Science Network (SWAHSN) is one of 15 regional organisations across England, set up by the NHS in 2013 to identify and spread health innovation at pace and scale.

TGE was commissioned by the SWAHSN to explore opportunities to strengthen the connection between supply and demand for funding and finance for VCSE models of care.

SWAHSN has since rebranded as Health Innovation South West.

View Report

South Yorkshire Pensions Authority (SYPA)

South Yorkshire Pensions Authority (SYPA) is responsible for administering the Local Government Pension Scheme in South Yorkshire.

As a responsible investor committed to sustainability, SYPA commissioned The Good Economy to review the place-based impact of its portfolio. The PBII Reporting Framework factsheet we developed for SYPA was included in their 2022/2023 Annual Report.

Sumerian Foundation

Sumerian Foundation is a registered UK charity supporting start-up and growing social purpose organisations to tackle social inequality in the UK by providing long-term “impact-first” funding and skills support.

The Good Economy reviewed and strengthened Sumerian Foundation’s existing impact management practices and worked with the early growth charities and social enterprises to evaluate their use and reporting of social impact metrics.

Sustainability for Housing

Sustainability for Housing (SfH) is a company limited by guarantee and run by a voluntary board that is responsible for the development, promotion and strategic direction of the Sustainability Reporting Standard for Social Housing (SRS).

TGE led the development of the SRS and serves as the Secretariat. In addition, TGE publishes an annual review of the Standard and sets out future directions of travel.

View Report

UBS Optimus Foundation

The UBS Optimus Foundation (UBS-OF) is a grant-making foundation that offers UBS clients a platform to use their wealth to drive positive social and environmental change. UBS-OF were at the forefront of funding innovative social finance and have a 20-year track record of philanthropic impact applying an investment-based approach.

TGE was engaged to provide feedback on UBS-OF’s current impact measurement and management system. UBS-OF sought to understand how its practices compare to both established industry standards and emerging impact management norms, as well as to identify opportunities for continuous improvement.

View Case Study

Urban Land Institute

The Urban Land Institute (ULI) is a global, member-driven organisation with more than 45,000 real estate and urban development professionals. ULI’s mission is to shape the future of the built environment for transformative impact in communities worldwide.

TGE was commissioned to co-author a report providing a roadmap for measuring and accounting for social value within the real estate industry.

View Report

Southampton City Council

Southampton City Council is the local authority of the city of Southampton. It is a unitary authority, having the powers of a non-metropolitan county and district council combined. Southampton had a population of 253,651 at the 2011 census, making it one of the most populous cities in southern England.

Southampton City Council is a Founding Member of TGE’s Place-Based Impact Investing Network.

The Impact Programme

The Impact Programme is the UK government’s flagship impact investing programme, which aims to increase investment into businesses in Sub-Saharan Africa and South Asia. In its first phase, TGE led the programme’s impact measurement and management workstream in partnership with PwC. We also played an active role in seeding new market building innovations, including the Impact Management Project and Acumen Lean Data (now 60 Decibels), as well as supporting the CDC Group to set up a measurement system for its high impact fund.

View Case StudyView Report

Wakefield Council

Wakefield Metropolitan District Council serves about 325,000 people in a district which includes Wakefield, Castleford, Pontefract, Featherstone, Normanton, Knottingley, and Hemsworth.

Wakefield Council is a Founding Member of TGE’s Place-Based Impact Investing Network.

London Pensions Fund Authority

The London Pensions Fund Authority (LPFA) provides a high-quality, cost-effective pension to benefit 99,585 members, 115 contributing employers, London’s communities and the wider society. TGE worked with LPFA to produce their first place-based impact report. TGE carried out an independent assessment of LPFA’s UK infrastructure and real estate portfolio using our PBII reporting framework.

View Report

Credentials

From speaking at conferences to developing materials and resources for the impact investing ecosystem, The Good Economy is at the forefront of impact – bringing insight, leading discussions, and moving the industry forwards.

Industry-Leading Expertise

With deep, extensive experience across impact investment, sustainable development, and place- based value delivery, we provide clients with the latest thinking and most rigorous impact measurement and management methodologies.

Multidisciplinary Experience

We are a multi-disciplinary team with a collective heritage across sustainable economic development, finance, impact investing, monitoring and evaluation, and economic and social policy, having professional experience across the public, private and social sectors.

System Builders

Our team is uniquely well-positioned to drive good practice in impact measurement and management having been at the forefront of developing industry norms and standards such as the Impact Management Project and the Sustainability Reporting Standard for Social Housing, for which we serve as the Secretariat.

“The Good Economy’s analysis was thorough and insightful, and helped us frame how we can think about managing for impact in a credible way across the business.” Jen Braswell, Head of Impact for EQT Private Capital

“The Good Economy team’s thoughtful and insightful work helped shaped our initial plans for the new agency and has given us a valuable source of evidence on which to draw as we shape our future priorities.”Professor Russel Griggs, OBE, Chair South of Scotland Enterprise

“We are pleased to have worked with The Good Economy on our 8th annual social impact report which offers a rigorous assessment and insight, giving investors a holistic view of the challenges and successes of delivering impactful affordable homes."Adrian D’Enrico, Fund Manager, Funding Affordable Homes

"With The Good Economy's support, creativity and recommendations we produced a report of excellent quality that has caught the attention of government and other key stakeholders."Community Land Trust Network

“The Good Economy is a critical friend. They challenge us on our thinking, and although we don't always agree, we accept that their independence is vital to maintain the rigour of analysis and hold us to account.” Hugo Llewelyn, CEO, Newcore

“It was a pleasure working with The Good Economy. Their dedication and passion helped us develop a bespoke social impact measurement framework that is potentially ground-breaking for the industry.” Tom Wilmot, Joint Managing Director, Capital&Centric

“The Threadneedle Social Bond Fund couldn’t have happened without The Good Economy’s commitment to social change and intellectual rigour in creating the social asses"Nigel Kershaw OBE, Executive Chair, Big Issue Invest

“The Good Economy has been a valuable partner for us, helping to shape and strengthen our impact strategy and methodology to focus on achieving our overall mission as an impact investment fund.”Dana Deardorff, Global Director, J&J Impact Ventures

"The 'Scaling up Institutional Investment for Place-Based Impact' white paper established the terms of discussion on PBII in the UK, and directly influenced the government's Levelling Up agenda." Jamie Broderick, Deputy Chair, Impact Investing Institute

Strategic Advisory Impact Services

Helping individual clients and partnerships understand how they can be more effective players in the impact investing ecosystem by understanding:

- What strategic levers they have access to, and how to deploy them

- What capabilities they need to build and what organisational structures they need to put in place

- Who they need to partner with

- What different players in the ecosystem are looking for

- How to embed accountability for delivering desired outcomes in long-term arrangements

Local Government Context

Combined Authorities are at a crucial stage in their evolution.

The trend towards increasing devolution of powers and consolidated capital funding streams provide new opportunities for more strategic place-based investment reflecting local priorities

BUT

The pattern is inconsistent across the country and there is a lack of institutional capacity in economic development. Overall, the volume of public investment available will not be sufficient to meet the challenge.

SO

Authorities need support to build a pipeline of investable propositions and establish the credibility to work with private investors – including capability building in key areas.

Asset Manager Context

At the same time, investors increasingly have an appetite to invest in UK assets that have a demonstrable positive contribution towards environmental, economic and social goals.

BUT

They often struggle to work out where best to engage outside the big cities to deliver acceptable risk-adjusted returns alongside meaningful impact. There is a lack of visible investable propositions and credible counterparties, and they lack knowledge of the true pattern of needs on the ground.

SO

Investors need to find more effective ways to identify and build partnerships with the right people, identify and filter opportunities, co-create commercial models that work for all parties, understand local needs and articulate how you they can help address them.

By sharing pioneering and emerging approaches to impact investing, placed-based impact investing (PBII), systems change investing, and innovative finance leadership, through our own work as well as our networks, our strategic advisory impact services help clients to define a unique impact investing proposition and to play a leadership role in this arena.

Impact Measurement and Management Systems

Our Impact Services help clients to plan, manage, measure and report on their contribution to positive social and environmental outcomes by developing impact measurement and management (IMM) systems that integrate a focus on real-world outcomes into their processes and decision-making.

We support clients in developing practical frameworks that align with their business strategy and relevant industry norms such as the Sustainable Development Goals (SDGs), the Impact Management Project, and the Impact Principles.

Impact Measurement and Management Systems

By leveraging these frameworks, we enable our clients to effectively measure and manage the social impact of their investments, ensuring transparency and accountability.

“The Good Economy helps clients to define and set clear impact objectives with measurable KPIs that become part of their business strategy and performance reporting.”

Sustainability and Impact Reporting

Combining Quantitative and Qualitative Data for Comprehensive Assessments

The Good Economy’s reports are designed to provide a thorough analysis of your impact. We go beyond surface-level assessments to uncover the meaningful changes that your organisation is creating over time. By examining both intended and unintended consequences, we provide a comprehensive view of your contribution to real-world outcomes.

Our approach involves gathering quantitative and qualitative data, analysing trends and assessing the alignment of your initiatives with your intended objectives. We highlight areas of success, potential challenges and opportunities for improvement. Our assessments contribute to informed decision-making, strategic planning and effective communication of your sustainability and impact performance to stakeholders.

Whether you’re seeking to measure the social impact of a specific initiative or gain a comprehensive understanding of your organisation’s overall impact, our assessments offer valuable insights that can drive positive change and enhance your reporting.

Many of our clients work with us on a recurring basis, with six monthly or annual reports that form part of their corporate performance reporting.

ESG and Impact Due Diligence

We conduct independent due diligence to assess transactions’ impact opportunities and ESG risks. Our reports provide evidence-based insight into the likelihood of clients achieving their impact objectives, while also highlighting ways of enhancing positive outcomes and avoiding negative impacts.

Our comprehensive approach to due diligence involves analysing various aspects of each transaction to evaluate its potential. By examining the underlying factors and context, we strive to uncover opportunities that can drive positive change and contribute to sustainable development. Furthermore, our reports not only assess the likelihood of clients achieving their objectives but also provide actionable recommendations for maximizing positive effects.

Navigating the Evolving Landscape of Sustainability and Impact Management

We understand the importance of avoiding negative consequences, and our due diligence research helps identify potential risks and suggests strategies to mitigate them. Through our evidence-based insights, we aim to empower our clients to make informed decisions that align with their goals and create a lasting positive difference in the world.

Examples of Our Work

Focus on Understanding Real-World Outcomes and Stakeholder Perspectives

Investors demonstrate their impact integrity by commissioning our reports that hold them to account as to whether actual impact performance is meeting intentions. Our impact reporting provides transparency and accountability to all stakeholders, thus ensuring that strategies stand up to market scrutiny.

We provide a considered and independent opinion about the positive and negative impacts of our clients’ investments. Our reporting ranges from in-depth reporting for clients focused on a single social challenge (e.g., homelessness) to analysing and reporting on the impact of multi-sector global portfolios.

PBII Reporting

Individual savers and investors, including local government pension scheme members, are increasingly asking how their money is making a meaningful difference and contributing to tackling the UK’s regional and social inequalities.

We have developed the Place-Based Impact Investing (PBII) Reporting Framework, in partnership with a group of Local Government Pension Funds and asset managers, to provide a common, consistent, transparent methodology for pension funds to report on the impact of their investments. This reporting approach has now been adopted by progressive local government pension funds. We believe place-based impact reporting will become the norm in a few years as pension funds respond to public interest in understanding how their money is invested.

- For asset owners including local government pension schemes, defined contribution funds, other pension fund managers and endowments, we provide an impact assessment and reporting service analysing the type and geography of investments and their contribution to local, regional and national sustainable development goals in order for them to communicate this important information to their members and trustees, alongside annual financial reporting.

- For asset managers (fund managers), we provide investment portfolio analysis resulting in a factsheet of the sub-national impact their fund is making in order for them to communicate this to investors and other stakeholders. We also provide an assessment of the strategy’s place-based impact investing traits and level of impact focus.

Research and Analysis

The Good Economy undertakes commissioned market research and feasibility studies, including place-based and sector studies. This includes understanding the underlying market systems dynamics and behavioural drivers of positive and negative development trends. Our team combines experience of quantitative and qualitative research methods to deliver industry-leading research and reports.

Examples of our work include:

Training on ESG and Impact

The Good Economy offers bespoke training to build the confidence and capability of leadership and investment teams responsible for integrated impact decision making. Training topics include:

- Fundamentals of impact investing

- ESG and impact measurement and management

- Understanding the impact investing industry – standards and trends

- Drivers behind market trends

TGE’s Training services are available for organisations of all types and can even be delivered one-on-one.

From Board level and executive team standalone training to team or divisional training as part of a larger engagement for capacity building, TGE’s Training services can be tailored to meet any need.

Case Studies

The Good Economy has worked with 150+ clients. While our work is often confidential we are proud to share a selection of case studies to demonstrate the depth and breadth of our work.

AEW UK Impact Fund

The Good Economy (TGE) was engaged by AEW UK in 2022 to set up an Impact Measurement and Management (IMM) Framework for what was then called the RRF. The RRF had launched in 2016, with a strategy to invest in a range of real estate sectors aiming to align the real benefits of property with the needs of long-term savers.

With a view to leveraging the positive place-based impact potential of real estate investment, AEW UK commissioned TGE to design a formal approach to convert this existing strategy into one that could credibly claim to be an ‘impact’ fund - as a result of which the AEW UK Impact Fund was launched.

AEW UKIF – SDR Labelling

The Good Economy (TGE) has worked with AEW since 2022 to develop an approach to measuring and managing impact for a place-based, mixed asset real estate strategy, it's UK Impact Fund (UKIF) – see previous case study. In light of the new SDR Labelling requirements, AEW's UK Impact Fund needed FCA approval to retain its 'impact' label.

Read how TGE's impact measurement and management framework helped AEW's UKIF to become one of the first funds 'Day One' ready for the new rules that come into effect on 31 July 2024.

Columbia Threadneedle

Columbia Threadneedle Investments (CTI) is a leading global asset manager, entrusted with £491 billion on behalf of individual, institutional and corporate clients around the world. CTI is also a pioneer in bringing social bond investing to retail investors and The Good Economy sits on the Social Advisory Panel for their UK and Global Social Bond Fund.

Creative UK

Creative UK is a not-for-profit organisation dedicated to supporting the growth of the creative industries. The Good Economy provided a range of impact assessment and strategy consultancy services for its investment programme, delivering an independent Impact Report and conducting client surveys to provide feedback on the investment process from the investee's perspective.

TGE also advised on Creative UK’s scale-up strategy, which resulted in the creation of an investment subsidiary company and the raising of a £10 million from Triodos Bank to increase Creative UK’s investment activity.

EQT

Based in Sweden, EQT is one of the world's leading private equity firms. It is a purpose-led organisation with almost three decades of experience of investing in growth companies, delivering consistent and attractive returns across multiple geographies, sectors and strategies. Today, EQT has EUR 126 billion assets under management.

EQT wanted to understand what and how much positive social and environmental impact is occurring within its portfolio. The Good Economy was commissioned to conduct a review of a portion of EQT Private Capital’s portfolio. The review identified, in a consistent and comparable way, which companies may be generating positive outcomes for people and / or the planet and why.

Funding Affordable Homes

Funding Affordable Homes (FAH) is a social impact investment company investing in UK government regulated affordable housing. They have close partnerships with housing associations and local authorities. Working with local partners they use their capital to promote the delivery of additional homes and aim to provide a balanced return to our shareholders comprising an attractive mix of income yield and capital appreciation.

The Good Economy has acted as the social impact advisor to FAH since its launch in 2015. We carry out a social due diligence of all investments and produce an Annual Impact Report based on our independent assessment of FAH's impact performance.

Health Innovation South West

Health Innovation South West is one of 15 Academic Health Science Networks set up by the NHS in 2013 to identify and spread health innovation at pace and scale.

The Good Economy was commissioned to explore opportunities to strengthen the connection between supply and demand for funding and finance for VCSE models of care.

Impact Ventures by J&J Foundation

Launched in 2019, Impact Ventures by J&J Foundation is an impact investment fund within the Johnson & Johnson Foundation. Impact Ventures by J&J Foundation invests in companies and entrepreneurs innovating to improve health equity for underserved patients around the world.

The Good Economy worked with Impact Ventures by J&J Foundation to develop a robust impact framework and methodology and has over time continued to revise and refine the original framework. In addition, new tools have been developed and adapted to enable the framework, portfolio companies have been engaged and supported, and impact diligences and screenings have been conducted for new investments.

Joseph Rowntree Foundation

The Joseph Rowntree Foundation (JRF) is an independent social change organisation working to solve UK poverty through research, policy, collaboration and practical solutions.

JRF commissioned Small Change (NI) Ltd and The Good Economy to carry out a study to create a robust foundation for a new social investment strategy that would contribute to the four outcome areas of its anti-poverty strategy.

Newcore

Founded in 2011, Newcore Capital Management (Newcore) is a management-owned business, with assets under management of £500 million. As a specialist in social infrastructure investor in the UK, Newcore targets assets considered integral to the functioning of society. These assets enable the provision of essential services such as education, housing and transport.

Despite having confidence that its social infrastructure investments have a positive impact, Newcore wanted to better understand, measure and report on impact creation. In late 2022, The Good Economy (TGE) was commissioned to carry out a critical review of Newcore’s ESG approach, and to conduct an independent impact assessment of Newcore’s funds.

Oxfam

Oxfam GB was the Impact Advisor to The Enabling Microfinance Fund (EMF), which sought to address the exclusion from formal financial markets faced by entrepreneurs in low-income countries.

TGE was commissioned by Oxfam GB to carry out an independent assessment of the impact performance of EMF and produce an Impact Report for EMF’s current and potential investors.

We analysed portfolio data and conducted investee interviews to better understand where the EMF was delivering positive social impact, to capture learnings and to formulate recommendations for EMF’s future investment strategy.

The Impact Programme

The Impact Programme is the UK government’s flagship impact investing programme, which aims to increase investment into businesses in Sub-Saharan Africa and South Asia. In its first phase, TGE led the programme's impact measurement and management workstream in partnership with PwC. We also played an active role in seeding new market building innovations, including the Impact Management Project and Acumen Lean Data (now 60 Decibels), as well as supporting the CDC Group to set up a measurement system for its high impact fund.

Related Reading

Catch up with the latest news and thought leadership from The Good Economy

Get in Touch

"*" indicates required fields